Why migrate your card programme?

For banks and financial institutions, outdated card systems create operational inefficiencies, compliance risks, and customer dissatisfaction. Whether you're switching processors, modernising legacy infrastructure, or optimising programme performance, migration is inevitable—but it doesn’t have to be complex or risky.

We surveyed top payment experts who have undergone challenges of their own migration programmes, and find some common concerns:

- Lack of innovation: 42% of businesses report that their providers fail to deliver future-forward solutions.

- Insufficient support: 38% highlight inadequate support as a major pain point.

- Collaboration challenges: 64% of businesses emphasise the importance of expert teams, effective planning, and seamless teamwork for a successful migration.

At Enfuce, we understand your concerns. Our migration process ensures that all these critical needs are met, making the transition seamless and risk-free.

The Enfuce advantage: A smarter way to migrate

Why you should trust Enfuce with your card migration programme:

Cloud-native platform

Move to a scalable, modern infrastructure with 99.999% uptime.

Risk mitigation strategies

Minimise disruptions with our structured approach.

Regulatory compliance built-in

Stay aligned with PCI DSS, PSD2, and local regulations

Dedicated programme management

Work with a team that has successfully migrated millions of cards

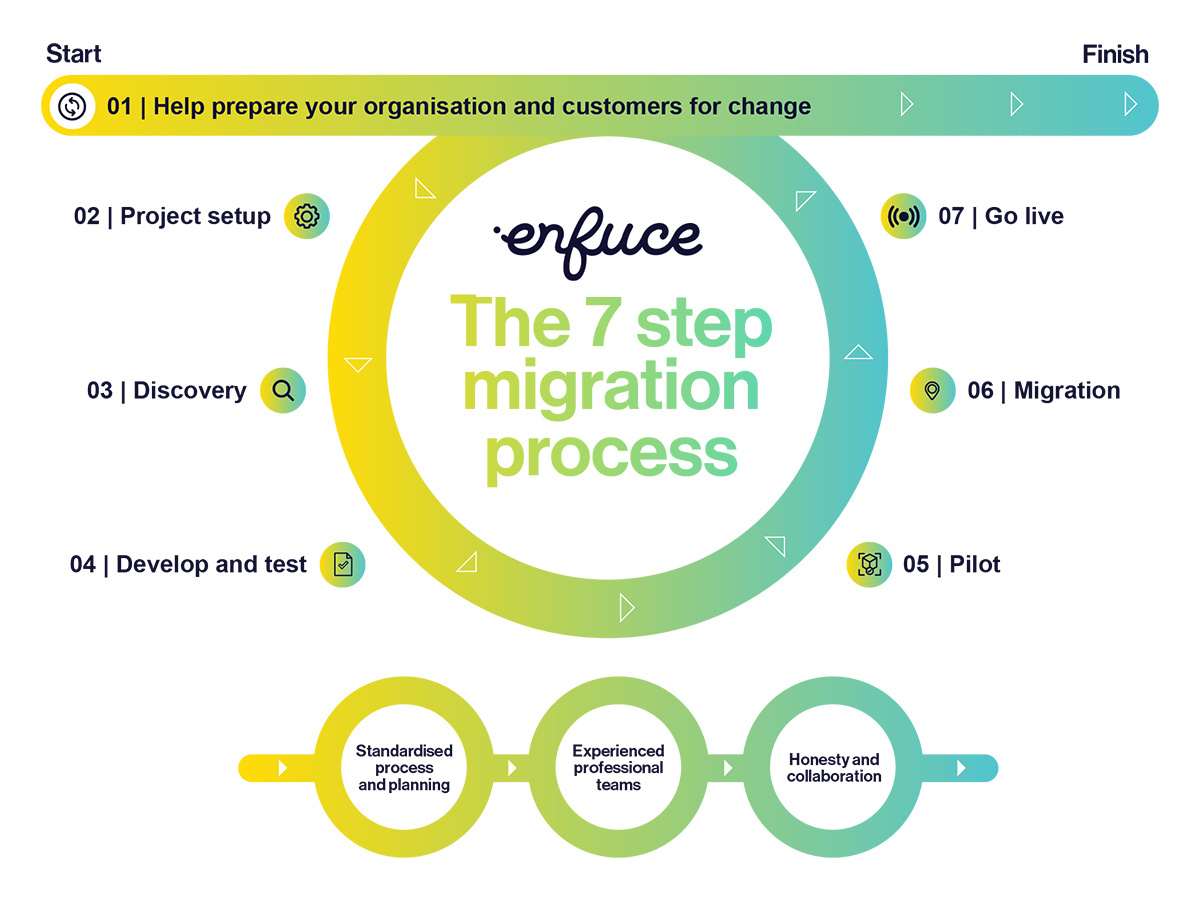

How our migration process works

We take a structured, risk-mitigated approach to ensure zero downtime and a seamless transition.

Step 1: Help prepare your organisation and customers for change

We work closely with your teams to align on goals, timelines, and communication strategies, ensuring readiness across all levels.

Step 2: Project setup

Our expert programme management team establishes the foundation for success by defining scope, objectives, and resources.

Step 3: Discovery

We perform an in-depth analysis of your existing systems, mapping out data, integrations, and compliance requirements.

Step 4: Develop and test

Using sandbox environments, we rigorously test data migrations, system integrations, and workflows to eliminate risks.

Step 5: Pilot

A phased rollout allows us to validate the migration strategy on a smaller scale, ensuring smooth implementation across the board.

Step 6: Migration

With proven processes, we securely migrate all data and configurations to Enfuce's cloud-native platform, ensuring zero downtime.

Step 7: Go live

The final step ensures a seamless transition, with real-time monitoring and support for optimal operations.

With Enfuce, your migration is in expert hands from start to finish.

Find out more about Enfuce's card migration programmes by downloading our 7-step process guide here

Success story: Pleo's seamless migration with Enfuce

Pleo partnered with Enfuce to migrate their existing card programme. Despite the complexities involved, the transition was smooth and efficient.

“Our partnership – or marriage if you like – started with transferring our existing customers onto the Enfuce platform and this was a huge endeavour and very risky. Because of the risk, we wanted to test the relationship thoroughly in the beginning.”

— Thorbjørn Fink, COO at Pleo

By choosing Enfuce, Pleo ensured a seamless migration, allowing them to focus on delivering exceptional services to their customers.

Explore our Migration blog series

Having successfully migrated millions of cards, we understand the power of expert support in any migration. Dive into our blog series to better understand the card migration process and how our expertise makes all the difference.

See our resources on card migration programmes

Get the insights from top migration experts via series of blog posts, case studies, and webinars

Can your card programme take you where you need to go?

Industry experts from Enfuce & Endava discuss their experiences and common pitfalls when switching card providers.

A perfect pair: finding the right partner

Gain insights from Pleo's COO on selecting the right partners and troubleshooting challenges in building a card program for your organization.

Building tomorrow’s bank

Christoffer Malmer (SEB) shares his experience in pivoting from traditional financial service to blazing a trail in Banking-as –a-Service (BaaS) via the build of a modular card program.

Take the next step. Secure your card programme migration.

Avoid the risks of outdated systems. Move to a secure, scalable card infrastructure with Enfuce.